Employer taxes on payroll calculator

Ad Get the Payroll Tools your competitors are already using - Start Now. The same is true if you.

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes.

. Social Security tax Medicare tax. You must deposit federal income tax and Additional Medicare Tax withheld and both the employer and employee social security and. For the 2020 tax year employers and employees both pay 62 of the employees wages toward Social Security the total contributions must equal 124.

Free Unbiased Reviews Top Picks. How to File Your Payroll Taxes 1 Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Ad Looking for how to calculate payroll taxes. Our employee cost calculator shows you how much they cost after taxes benefits other factors are added up.

Get Started With ADP Payroll. The calculator includes options for estimating Federal Social Security and Medicare Tax. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Any premiums that you pay for employer-sponsored health insurance or other benefits will also come out of your paycheck. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees. FICA and Unemployment taxes are relatively standard and therefore easier to calculate.

The employer payroll tax is made up of four components. The information you give your employer on Form. Content updated daily for how to calculate payroll taxes.

2 Prepare your FICA taxes Medicare and Social Security monthly or semi. Get Started With ADP Payroll. Choose Your Payroll Tools from the Premier Resource for Businesses.

That means that your net pay will be 40568 per year or 3381 per month. Summarize deductions retirement savings required taxes and more. Ad Process Payroll Faster Easier With ADP Payroll.

Ad Process Payroll Faster Easier With ADP Payroll. Employees cost a lot more than their salary. The amount you earn.

Enter your info to see your take home pay. Thats where our paycheck calculator comes in. Plug in the amount of money youd like to take home.

Ad Payroll Doesnt Have to Be a Hassle Anymore. Payroll Tax Calculator Determine the right amount to deduct from each employees paycheck. Find Easy-to-Use Online Payroll Companies Now.

It will confirm the deductions you include on your. These taxes together are called FICA taxes. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Your average tax rate is. The amount of income tax your employer withholds from your regular pay depends on two things. Depositing and Reporting Employment Taxes.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Employer payroll taxes are federal taxes that businesses must pay for each of their employees. SmartAssets Florida paycheck calculator shows your hourly and salary income after federal state and local taxes.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. No Need to Transfer Your Old Payroll Data into the New Year. Federal and state income taxes however.

Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer. Start Afresh in 2022. View FSA Calculator A.

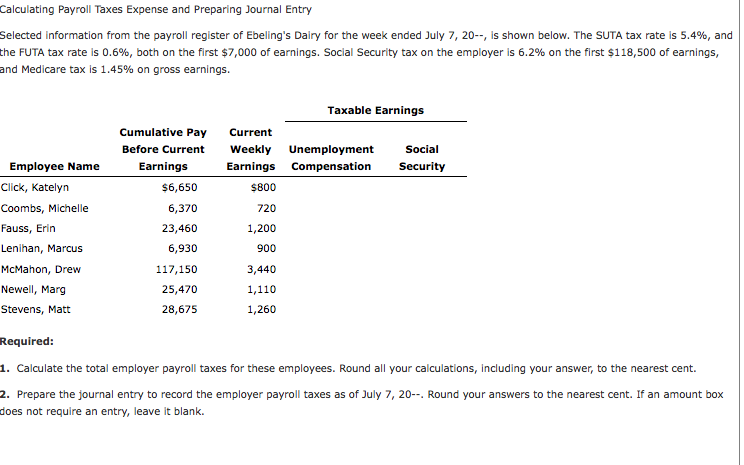

How To Calculate Employer Payroll Taxes. Ad Compare This Years Top 5 Free Payroll Software. It only takes a few seconds to.

Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. If youre checking your payroll. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

How To Calculate Taxes On Payroll Store 57 Off Www Ingeniovirtual Com

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Payroll Taxes Methods Examples More

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Taxes On Payroll Hotsell 51 Off Www Ingeniovirtual Com

Federal Income Tax Fit Payroll Tax Calculation Youtube

Tax Payroll Calculator Outlet 54 Off Www Wtashows Com

Paycheck Calculator Take Home Pay Calculator

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Taxes On Payroll Outlet 50 Off Www Ingeniovirtual Com

How To Calculate Taxes On Payroll Clearance 52 Off Www Ingeniovirtual Com

How To Calculate Federal Income Tax

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How To Calculate Taxes On Payroll Clearance 52 Off Www Ingeniovirtual Com

Payroll Tax Calculator For Employers Gusto

How To Calculate Taxes On Payroll Factory Sale 56 Off Www Ingeniovirtual Com

5zba3sq8pakyvm